Keep Your Mortgage and Win In Life

How the impact of mortgage payments decrease over time

There are two types of people in this world: those who pay down their mortgage as fast as possible and those who don’t. Let’s touch on three points explaining why most Americans should consider maintaining their mortgage payments for 30 years. This article is for anybody with a mortgage but especially those with mortgage rates in the 2’s and 3’s.

#1 Large amounts of equity can actually stifle growth

There is a saying we personally live by when making financial decisions: you finance everything you buy. With every financial decision any of us make we either pay interest or we forego interest that we could’ve earned. Specifically with mortgage debt, when we accelerate the amortization schedule of this type of good debt we transfer cash, which is liquid, into equity which is illiquid. In the higher interest rate environment that we’re in nowadays it’s costly, and time consuming, to recapture control of this wealth again. Having ample liquidity simply allows us to partake in amazing opportunities that can alter the trajectory of our lives for the better. I’ve been sharing this idea with people (to not pay down their mortgages) since 2013 and when I used to receive push back it almost always came with “but I can refinance down the road if I need the money”. With interest rates north of 8% at the time of this writing, refinances more and more don’t make sense.

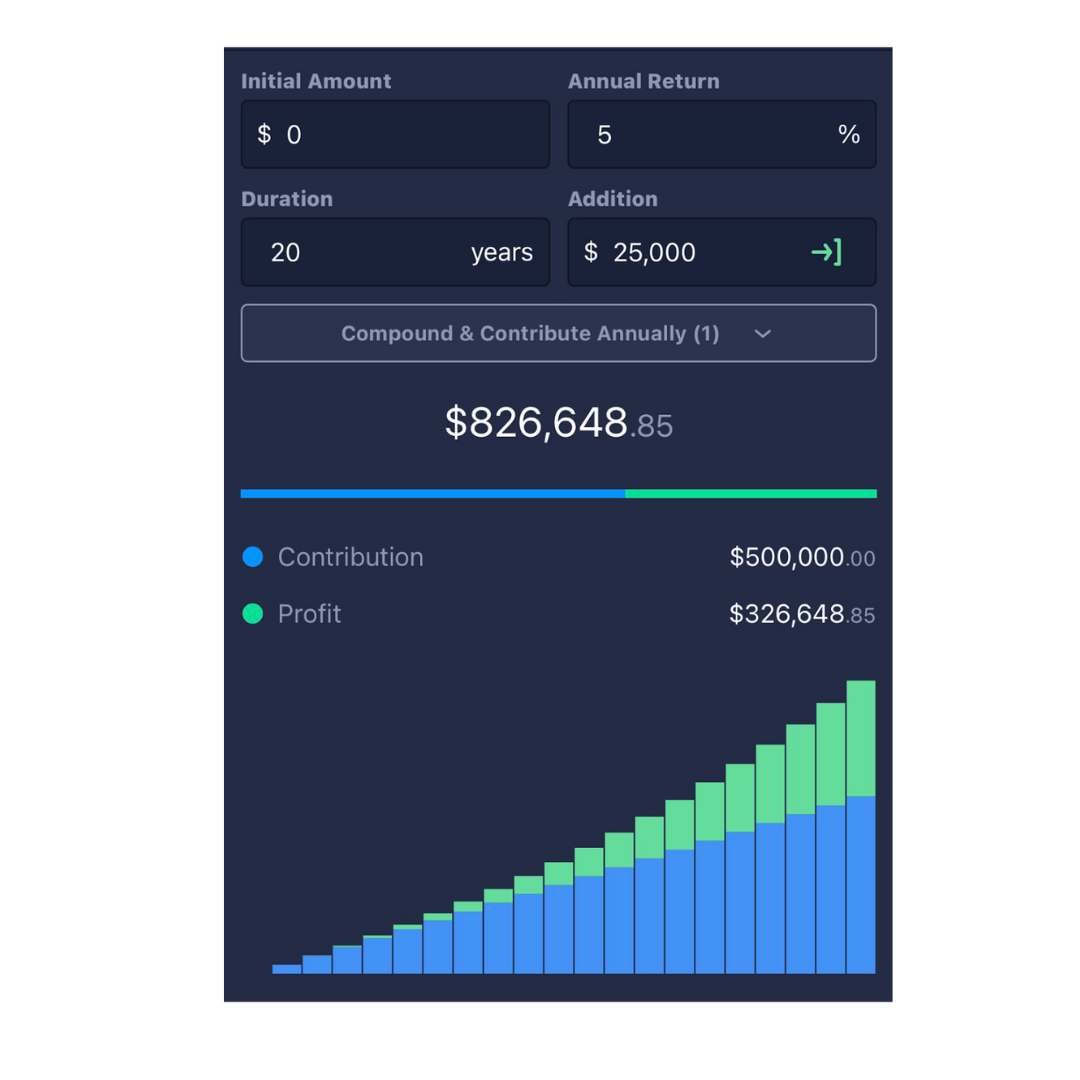

So instead of paying down your mortgage in less than 30 years, consider investing that same amount of capital to increase your cash flows in other areas. Assuming a 3% mortgage rate, if you were to pay down your mortgage the savings is just that, 3% annually and that capital is out of reach. Conversely, let’s look at what happens if you invested this capital at a modest rate of return. Figure A below shows an annual contribution of $25,000 into a vehicle earning 5% annually for 20 years.

Figure A: Over 20 years we’ve invested $500k which compounds to $826,649, netting us $326,649 in growth.

What I think is most important to understand here is depending on where you deployed this annual contribution the entire nest egg could be accessible for opportunities that might yield an even better rate of return elsewhere, or for handling emergencies when they arise. Money solves problems but only when we have access to it so I say Liquidity is King. Storing excess savings as equity in your primary residence can quickly stifle your growth, preventing you from experiencing your full potential.

#2 Having no mortgage payment can have a smaller impact than you might think

The negative impact of mortgage payments decreases over time! If you’re hung up on this concept let’s look at how a mortgage is a fantastic hedge against inflation. Most years there is inflation in the economy where goods and services increase in cost which further devalues the dollar. Fixed rate mortgages are level. As we all go through life making more and more money through pay increases and promotions a level mortgage payment becomes a smaller part of our overall budget. This is true for any debt instrument offering fixed rate financing (I’m not accounting for tax and insurance, of course). This might not sound impactful in a year or even in 5 years but zoom out a bit and look at how this might impact your life in a couple of decades. I recently met a women who bought her primary residence in Phoenix Arizona in 2004 and has a $650 monthly mortgage. She acknowledged the fact that single rooms for rent cost more than that these days. Over the years she has more than doubled her income so her mortgage payment has a nominal impact on her financially today. This has allowed her to invest her hard earned money elsewhere allowing her to have a better lifestyle. With a level mortgage payment every month there will be more to invest as wages and cash flows increase over time. If our goal is to be great stewards of our money I think it’s imperative to adopt strategies that counter the devaluation of the Dollar. There isn’t anything easier than riding out one’s primary mortgage!

With a level mortgage payment every month there is more to invest as wages and cash flows increase over time.

#3 Not having a mortgage might be what’s preventing you from reaching “accredited investor” status.

Many of our clients at Axiom enjoy investing in real estate through apartment syndications. The returns can be great and it’s a very passive way to invest. However, many of these opportunities require one to be an “accredited investor”. For those that don’t know, an accredited investor simply means you either earn $200,000 a year ($300,000 if married) and have done so for the last two years or you have a net worth of $1,000,000 excluding the equity in your primary residence. We regularly speak to people who are on the cusp of reaching this latter milestone. Maintaining wealth outside of the equity in your primary residence can accelerate the path to achieving accredited investor status and paying extra towards your mortgage might be what’s preventing you from being able to invest in these types of passive opportunities.

With all of us having finite access to capital it’s key that we make efficient decisions that don’t necessarily increase our risk. Maintaining your mortgage debt will allow you to seek out greater rates of return elsewhere, you will maintain a built in hedge against inflation along the way, and lastly, it will free up cash allowing you to partake in some pretty cool investments as you navigate life.

Maintain control of your hard earned money, put it to work efficiently, and live intentionally,

-Mike Bargetto

P.S. Watch this video to see how paying down your mortgage early could cost you millions.