Empowering Kids with Financial Literacy

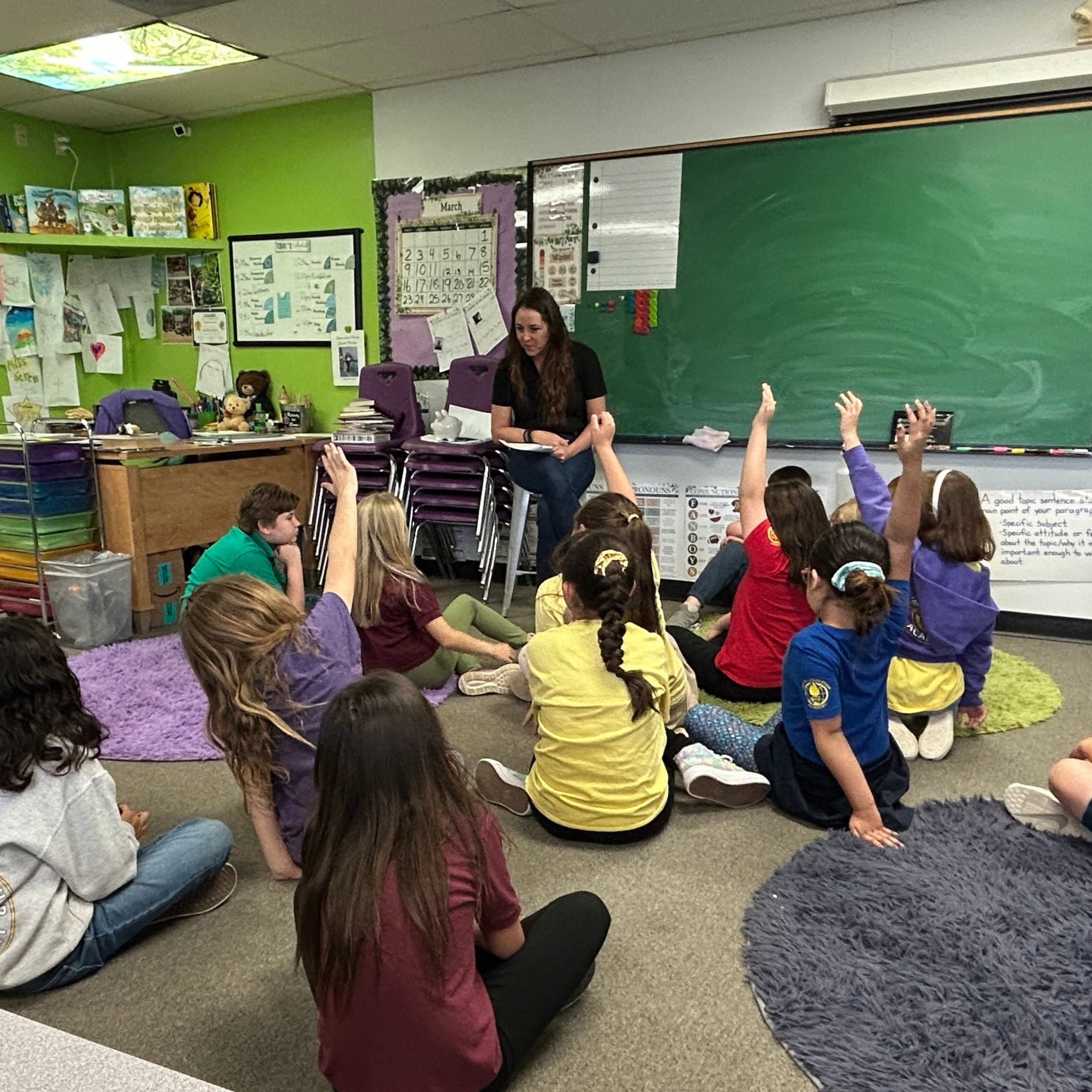

Katie in a grade school classroom

A Morning at Liberty Leadership Academy

Earlier this spring, I had the joy of spending a morning at Liberty Leadership Academy, a vibrant charter school in Cottonwood, Arizona, where I taught a financial literacy masterclass to two groups of bright, curious students—one class of 3rd and 4th graders and another of 5th and 6th graders. What unfolded in those classrooms was more than just a lesson about money—it was a spark of empowerment.

Making Financial Concepts Relatable

The theme of the class was “The Power of Saving,” and we kept it simple, age-appropriate, and interactive. We began with the basics:

What is money?

Why do people need it?

What kinds of things do you want to save for?

These opening questions set the stage for thoughtful dialogue. The students shared answers ranging from saving for pets and video games to buying gifts for loved ones.

Lily’s Big Goal: A Story That Resonated

I shared a story called “Lily’s Big Goal,” about a 10-year-old girl saving up for a bike. Through bake sales and extra chores, Lily demonstrated how discipline and creativity could help reach a goal faster—but she also faced temptations, like spending her savings on a video game.

I paused throughout the story to ask questions like:

“What would you do in Lily’s shoes?”

“How could she earn money faster?”

The responses were thoughtful and practical. “She could walk dogs!” one student said. Another added, “Maybe she could make bracelets to sell.” It was clear they were not only absorbing the lesson—they were applying it to their own lives.

Needs vs. Wants: A Valuable Distinction

We transitioned into a discussion about needs vs. wants, an important building block for making smart spending choices. I named items like ice cream, shoes, and fruit, and the students sorted them into categories. This exercise led to some rich conversations—especially when discussing “gray areas” like whether designer clothes were a need or a want.

Setting Goals They Can See

We moved into goal-setting, encouraging each student to identify both a short-term and long-term savings goal. Whether it was saving $10 for a book or $100 for a family vacation, the exercise helped them visualize how small steps could add up over time. We practiced calculating how much they could save each week and how long it would take to get there—a simple but powerful math connection.

The Piggy Bank Challenge

One of the highlights of the class was our Piggy Bank Challenge. Each student received a piggy bank and wrote down the first thing they wanted to save for. Then, they got a scenario: “You receive $10 for your birthday. How much do you want to save? How much do you want to spend?”

Many kids chose to save the majority of it—some even all of it. When I asked why, their answers were sincere: “Because I really want to buy a gift for my mom,” or “Because I want to reach my goal faster.” These are the kinds of moments that stick with you.

What’s Next: Introducing Investing

If I return to teach again (and I hope to!), I’d love to begin introducing the concept of investing—not with stock tickers or real estate, but with the big idea that money can work for you. Shifting from an “earn and spend” mindset to one where money creates more money is a transformational idea—and one that kids are capable of grasping far earlier than we often think.

Axiom’s Ongoing Commitment to Financial Literacy

At Axiom Wealth Solutions, we believe that financial literacy is foundational to building a life of intention and abundance. This class was part of our broader mission to give back and help families—and future families—by creating lasting wealth, not just in dollars, but in confident decision-making.

If you’re a parent, teacher, or school leader and would like to see the lesson plan or student workbook I used, I’d be happy to share it. Just send me an email at katie@axiomwealthsolutions.com.

Together, let’s raise a generation that saves with purpose, spends with intention, and believes in their own financial future.